Make charting stock an interesting read and analysis. Know behind the story of each chart and significance.... Probably it's okay to speculate.

Sunday, July 21, 2013

INTERESTING CHART PATTERNS of some Philippine Stocks part 2

Note: This is not a solicitation of buy or sell recommendation. Place your trade at your own risk. This is an opportunity to cross check notes and ideas.

INTERESTING CHART PATTERNS of some Philippine stocks Part 1

Disclaimer: Not a buy or sell recommendation. All opinion are based on personal opinion and does not command any authority of any sort. Please be guided accordingly that these charts are for educational purposes. Base your investment and trades in your own analysis.

Sunday, July 7, 2013

Tuesday, July 2, 2013

ALI JULY 2 2013

Note: This is not a buy or sell recommendation. Trade at your own risk. Make your trade base on your own decision and interpretation.

Disclaimer: http://chartbuzz.blogspot.com/2013/05/disclaimer-on-chart-buzz.html

ALI's chart looks interesting.... a broadening formation that might suggest falling prices ahead. Should price do start falling plan your trade ahead. However, should prices not fall as reasonably believed, then we should revisit the chart again some time soon.

Disclaimer: http://chartbuzz.blogspot.com/2013/05/disclaimer-on-chart-buzz.html

ALI's chart looks interesting.... a broadening formation that might suggest falling prices ahead. Should price do start falling plan your trade ahead. However, should prices not fall as reasonably believed, then we should revisit the chart again some time soon.

COL JULY 2 2013

A possible tradable range. Note: This is a not a recommendation to buy nor sell, but rather a piece of chart for the purpose of educational entertainment only.

Sunday, June 30, 2013

Sunday, June 23, 2013

TA JUNE 23 2013

Will TA be like cpg? or will it be a different story? Note: This is not a buy nor sell recommendation. This is only for educational entertainment purposes only. Base your decision in your own interpretation, and at your own risk.

VMC JUNE 23 2013

Note: This is not a buy nor a sell recommendation. Please be reminded that any risk you take is yours alone. The chart is provided for educational entertainment and future reference purposes only. Don't take this as a recommendation since the author might possibly be biased and therefore may provide wrong analysis.

VMC is still looking good despite the overall market slump. Possibly one of the few stocks among the 10% that are not much affected by the foreign selling frenzy triggered by the comments of current US Fed chair Bernanke.

VMC is still looking good despite the overall market slump. Possibly one of the few stocks among the 10% that are not much affected by the foreign selling frenzy triggered by the comments of current US Fed chair Bernanke.

Saturday, June 15, 2013

CPG JUNE 15 2013

Thursday, June 13, 2013

Wednesday, June 12, 2013

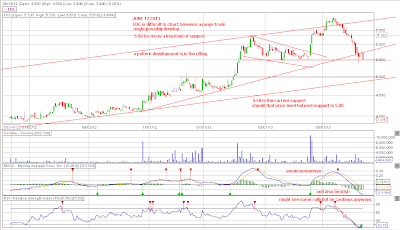

FGEN JUNE 12 2013

Note: This is not a buy nor sell recommendation, but rather for intellectual entertainment only. Buy and sell at your own risk. There's no intent to solicit a buy nor sell.

VMC JUNE 12 2013

VMC worth a second look. Note that this is not a buy nor sell recommendation. All risks are your alone to bear. Be responsible in all your trades.

Tuesday, June 11, 2013

SMPH JUNE 12 2013

http://chartbuzz.blogspot.com/2013/05/disclaimer-on-chart-buzz.html

Note that this is not a recommendation to buy nor sell, but rather an opinionated analysis that might contain error!

Note that this is not a recommendation to buy nor sell, but rather an opinionated analysis that might contain error!

PCOMP JUNE 12, 2013

Tentative view on Psei index. Our Philippine index is trying to tell us something with the pattern development. Although the index is still in the process of completing the potential head and shoulder or bearish megaphone with partial rise. Charts are painting a very bearish picture in convergence with the foreign sell off. Also note that the prices are becoming very volatile, either up a hundred points the next day, and then down for some consecutive days. Our stance is to be cautious and prepare for some bearish reversal. Note also that level 7000 is a strong psychological resistance. It can be an opportunity to sell for others who wants to trim their exposure to equities.

Sunday, May 12, 2013

VUL MAY 12 2013

VUL might be forming a cup and handle. This is Vul's weekly chart. I think within the Cup and handle, we can subjectively add another pattern. I see an ascending triangle. I think the market is anticipating something on VUL. Yes, it is public knowledge that there's a rumor on the backdoor listing of National Bookstore. Aside from that, I guess the chart captures another story. Perhaps its the fundamental side of the story then.

Disclaimer!

Disclaimer!

WEB MAY 12 2013

Disclaimer!A spider has begun spinning his web back into shape. This stock is making it's move higher after consolidating for almost 5 months. We need to see if this stock will create a higher high and a higher low, plus establish a definite trendline. Note that Trendline 2 is tentative. we need it to be validated by a price touch in the future. Definitely the price touch should be at higher price. We now see RSI downtrend has depicted a break with price following the break from the range (not drawn but should be easy to spot). Macd showing some sign of momentum which is pretty good.

Again always check back your charts, as technical readings changes daily.

Saturday, May 11, 2013

MAY 12 2013 DNL

DISCLAIMER!

Note: Author wants to remind readers that this is for the blog owner's personal educational purposes and the public's entertainment consumption only. This article does not wish to convey a buy or sell advisory nor any form of solicitation. Your trades are your own responsibility.

DNL attracted my attention since it's full of attention right now. Thought of giving it a shot at charting and analyzing the current situation of DNL. The chart comments are full of uncertainty. Again, let readers be reminded that possibilities are never certainties. All target prices are hypothetical and subjective possibilities in nature. It is similar to coming up with a potential fair value with all available assumptions and existing data on its earnings and other fundamental figures.

DNL might possibly show an example of a measure move. Wherein the feat of the former leg will be repeated in the formation of the second leg. Always though, take caution that it doesn't always reach the target, and may sometimes overshoot or undershoot the target. Target assumptions might vary from analyst to analyst.

What we need to see in DNL right now is an established second leg up trend line wherein like the first uptrend would be tight and reliable. Macd for this stock seems to indicate a possible higher price appreciation. Further analysis should be done once more prominent price movements have materialized in the future. Technical readings changes daily; therefore it warrants that you check your charts daily.

As of now, I personally believe the market will allow DNL to move full steam ahead to higher prices. New higher highs and higher lows establishing a valid trendline should hammer out confidence on DNL. Always remember let the market Determine the New Leg should it continue the first leg run up.

Note: Author wants to remind readers that this is for the blog owner's personal educational purposes and the public's entertainment consumption only. This article does not wish to convey a buy or sell advisory nor any form of solicitation. Your trades are your own responsibility.

DNL attracted my attention since it's full of attention right now. Thought of giving it a shot at charting and analyzing the current situation of DNL. The chart comments are full of uncertainty. Again, let readers be reminded that possibilities are never certainties. All target prices are hypothetical and subjective possibilities in nature. It is similar to coming up with a potential fair value with all available assumptions and existing data on its earnings and other fundamental figures.

DNL might possibly show an example of a measure move. Wherein the feat of the former leg will be repeated in the formation of the second leg. Always though, take caution that it doesn't always reach the target, and may sometimes overshoot or undershoot the target. Target assumptions might vary from analyst to analyst.

What we need to see in DNL right now is an established second leg up trend line wherein like the first uptrend would be tight and reliable. Macd for this stock seems to indicate a possible higher price appreciation. Further analysis should be done once more prominent price movements have materialized in the future. Technical readings changes daily; therefore it warrants that you check your charts daily.

As of now, I personally believe the market will allow DNL to move full steam ahead to higher prices. New higher highs and higher lows establishing a valid trendline should hammer out confidence on DNL. Always remember let the market Determine the New Leg should it continue the first leg run up.

Friday, May 10, 2013

ABA MAY 10 2013

DISCLAIMER!

DisclaimerThis is not a buy and sell recommendation. All your trades are your responsibility.

ABA caught my attention. It's an interesting study about RSI. ABA's price is currently playing along a range, while its RSI is creeping upwards. A tell tale sign of something possibly might occur but without certainty. Sometimes it's just a dud. Nada.

In the future I'll post some examples where in there's this exact situation but it came out a dud. This kind of stock is a penny stock and burns people easily. Usually charting and technical analysis tell us some sort of story is brewing. But don't get me wrong... the story might just not be there. Mind you there's a gap between 0.90 and 0.92 ish... Not sure what happened there. Price just went for a free fall.

Author went back a little further in time and discovered this. RSI also demanded some attention. Series of higher highs and higher lows formed. For other details refer to the chart above. This will be a great reference tool.

Please do not buy and sell stocks because they are shown in blogs. Do mind what you are getting into. In the end you'll be the responsible one. My blog doesn't encourage people to buy and sell stock. This blog is for the author's reference and the public's entertainment consumption only.

DisclaimerThis is not a buy and sell recommendation. All your trades are your responsibility.

ABA caught my attention. It's an interesting study about RSI. ABA's price is currently playing along a range, while its RSI is creeping upwards. A tell tale sign of something possibly might occur but without certainty. Sometimes it's just a dud. Nada.

In the future I'll post some examples where in there's this exact situation but it came out a dud. This kind of stock is a penny stock and burns people easily. Usually charting and technical analysis tell us some sort of story is brewing. But don't get me wrong... the story might just not be there. Mind you there's a gap between 0.90 and 0.92 ish... Not sure what happened there. Price just went for a free fall.

Author went back a little further in time and discovered this. RSI also demanded some attention. Series of higher highs and higher lows formed. For other details refer to the chart above. This will be a great reference tool.

Please do not buy and sell stocks because they are shown in blogs. Do mind what you are getting into. In the end you'll be the responsible one. My blog doesn't encourage people to buy and sell stock. This blog is for the author's reference and the public's entertainment consumption only.

Subscribe to:

Comments (Atom)

.png)

.png)

.png)