Make charting stock an interesting read and analysis. Know behind the story of each chart and significance.... Probably it's okay to speculate.

Sunday, June 30, 2013

Sunday, June 23, 2013

TA JUNE 23 2013

Will TA be like cpg? or will it be a different story? Note: This is not a buy nor sell recommendation. This is only for educational entertainment purposes only. Base your decision in your own interpretation, and at your own risk.

VMC JUNE 23 2013

Note: This is not a buy nor a sell recommendation. Please be reminded that any risk you take is yours alone. The chart is provided for educational entertainment and future reference purposes only. Don't take this as a recommendation since the author might possibly be biased and therefore may provide wrong analysis.

VMC is still looking good despite the overall market slump. Possibly one of the few stocks among the 10% that are not much affected by the foreign selling frenzy triggered by the comments of current US Fed chair Bernanke.

VMC is still looking good despite the overall market slump. Possibly one of the few stocks among the 10% that are not much affected by the foreign selling frenzy triggered by the comments of current US Fed chair Bernanke.

Saturday, June 15, 2013

CPG JUNE 15 2013

Thursday, June 13, 2013

Wednesday, June 12, 2013

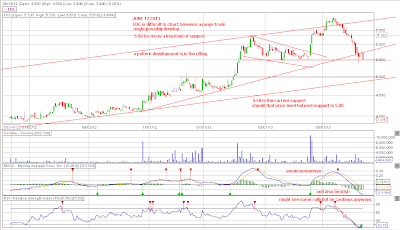

FGEN JUNE 12 2013

Note: This is not a buy nor sell recommendation, but rather for intellectual entertainment only. Buy and sell at your own risk. There's no intent to solicit a buy nor sell.

VMC JUNE 12 2013

VMC worth a second look. Note that this is not a buy nor sell recommendation. All risks are your alone to bear. Be responsible in all your trades.

Tuesday, June 11, 2013

SMPH JUNE 12 2013

http://chartbuzz.blogspot.com/2013/05/disclaimer-on-chart-buzz.html

Note that this is not a recommendation to buy nor sell, but rather an opinionated analysis that might contain error!

Note that this is not a recommendation to buy nor sell, but rather an opinionated analysis that might contain error!

PCOMP JUNE 12, 2013

Tentative view on Psei index. Our Philippine index is trying to tell us something with the pattern development. Although the index is still in the process of completing the potential head and shoulder or bearish megaphone with partial rise. Charts are painting a very bearish picture in convergence with the foreign sell off. Also note that the prices are becoming very volatile, either up a hundred points the next day, and then down for some consecutive days. Our stance is to be cautious and prepare for some bearish reversal. Note also that level 7000 is a strong psychological resistance. It can be an opportunity to sell for others who wants to trim their exposure to equities.

Subscribe to:

Comments (Atom)

.png)

.png)